From FTSE-100 to collapse in 1 year

Click here to read the article..

understating its debts by up to $4bn. Blackstar Capital helped place NMC Health debt into Luxembourg!! |

From FTSE-100 to collapse in 1 year Click here to read the article.. |

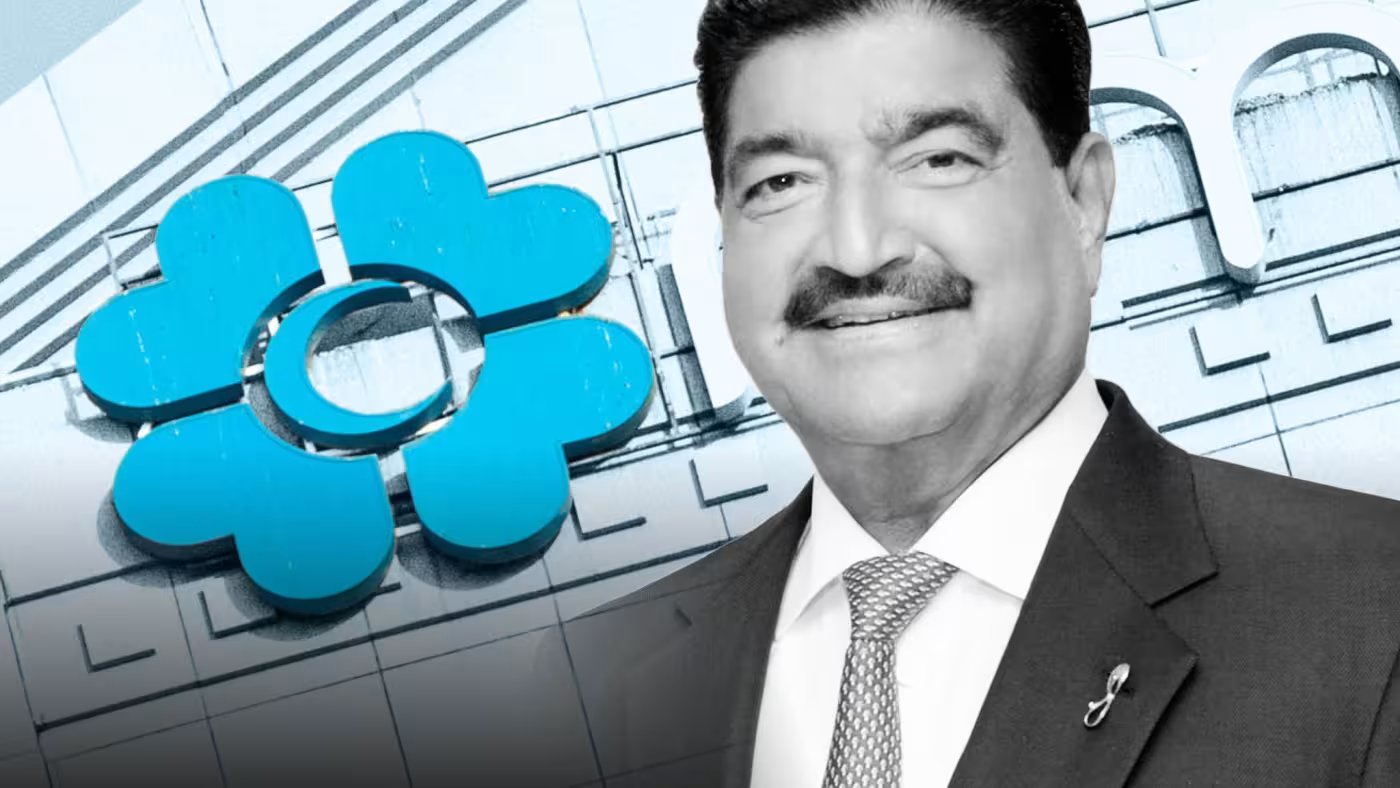

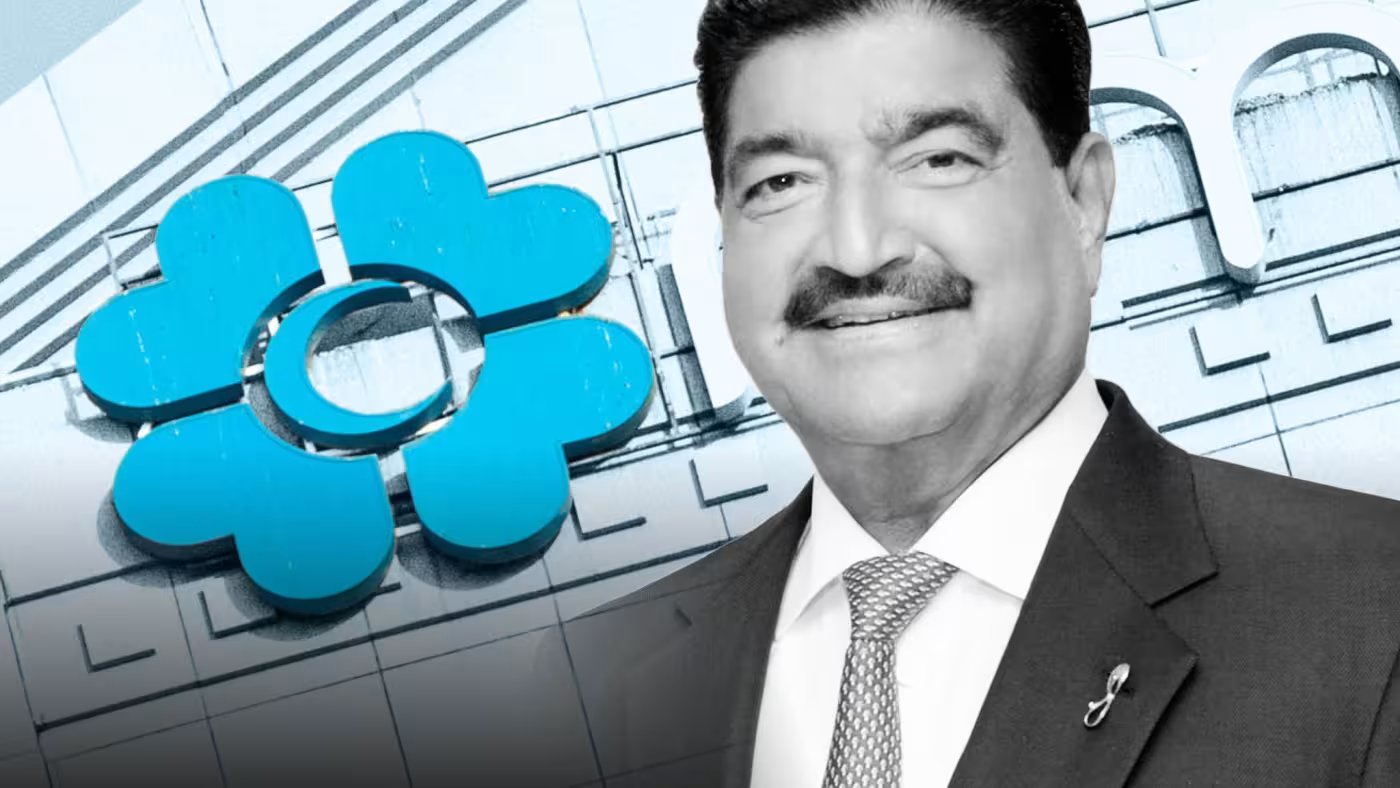

NMC Health was a London-listed healthcare operator, primarily running hospitals in the Middle East. It entered the FTSE 100 in 2017 after rapid growth and was valued at £8.6bn at its peak in 2018.

However, in late 2019 the shortseller Muddy Waters published a report raising questions over NMC's financial reporting and understated debt. In early 2020, the company fired its chief executive and confirmed financial discrepancies, before ultimately being forced into administration in April that year.

Blackstar Capital placed Supply Chain bonds issued by NMC Health into Luxembourg, with inter alia Credit Suisse Supply Chain funds buying a lot of this debt. With the default of the Lex Greensill's financial empire in March 2021, Credit Suisse Supply Chain funds, based in Luxembourg, collapsed within weeks in 2021, writing off over US$ 3 bn. of holdings.

Lex Greensill, Australian businessman, Queensland University of Technology law degree, 1994-2001. Daniel McGrath, Australian businessman, Queensland University of Technology law degree, graduating 2001...

The UK Regulator FCA said the company "published a series of financial statements and several clarification announcements, which contained materially inaccurate information about its debt position" between March 2019 and February 2020.

The following articles are some of the press coverage concerning the collapse of NMC Health, the understated debts, and the role

of Blackstar Capital :-

(17/11/23) Guardian - collapsed FTSE-100 NMC Health misled markets over $3.2 bn. of debt, says FCA

(20/12/19) FT - NMC Health & Blackstar held talks to raise €200m in off-balance sheet debt

===> Go to Top